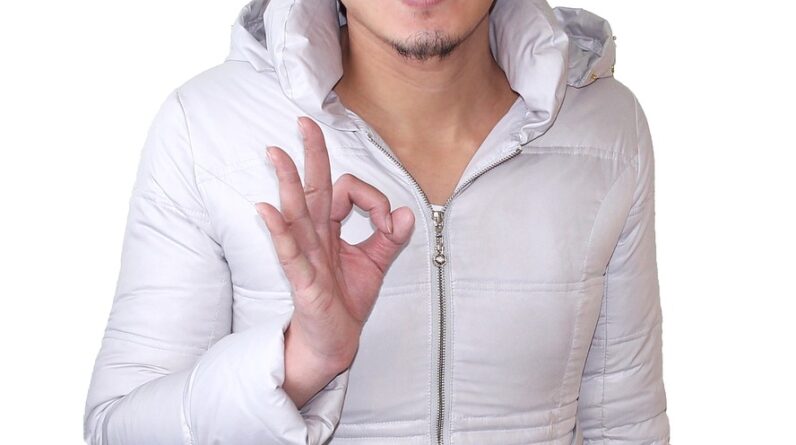

Have you ever wondered how debt consolidation can impact your credit score? In this article, we explore the potential effects of debt consolidation on your credit score. Whether it’s a positive or negative impact, understanding how consolidating your debts can affect your creditworthiness is essential. So, let’s dive into the world of debt consolidation and shed some light on its potential consequences for your credit score.

This image is property of images.ctfassets.net.

1. Overview of Debt Consolidation

1.1 Definition of debt consolidation

Debt consolidation refers to the process of combining multiple debts into one single debt. This is typically done by taking out a new loan to pay off existing debts, or by utilizing a debt consolidation program offered by a financial institution.

1.2 Purpose of debt consolidation

The main purpose of debt consolidation is to streamline multiple debts into a single payment, often with a lower interest rate. This can make it easier for individuals to manage their debts and potentially save money on interest payments over time.

1.3 How debt consolidation works

Debt consolidation works by taking out a new loan to pay off existing debts. This new loan typically has a lower interest rate than the combined interest rates of the previous debts, making it more affordable for the borrower. The borrowed amount is then used to pay off creditors, leaving the borrower with only one monthly payment to make towards the new loan. This consolidation of debts can provide individuals with a clearer path to becoming debt-free.

2. Understanding Credit Scores

2.1 Definition of a credit score

A credit score is a numerical representation of an individual’s creditworthiness. It is a three-digit number that indicates the likelihood of a borrower repaying their debts based on their credit history. Credit scores are used by lenders, landlords, and other financial institutions to assess the risk associated with lending money or providing services to an individual.

2.2 Factors that affect credit scores

There are several factors that can affect credit scores. These include payment history, credit utilization, length of credit history, types of credit used, and new credit inquiries. Payment history and credit utilization are particularly important, as they make up a significant portion of a credit score calculation.

2.3 Importance of credit scores

Credit scores play a crucial role in an individual’s financial life. They can determine the interest rates offered on loans, the ability to secure a mortgage or rental property, and even the cost of insurance premiums. Maintaining a good credit score is essential for accessing favorable financial opportunities and securing the best terms and rates.

3. Debt Consolidation and Credit Scores

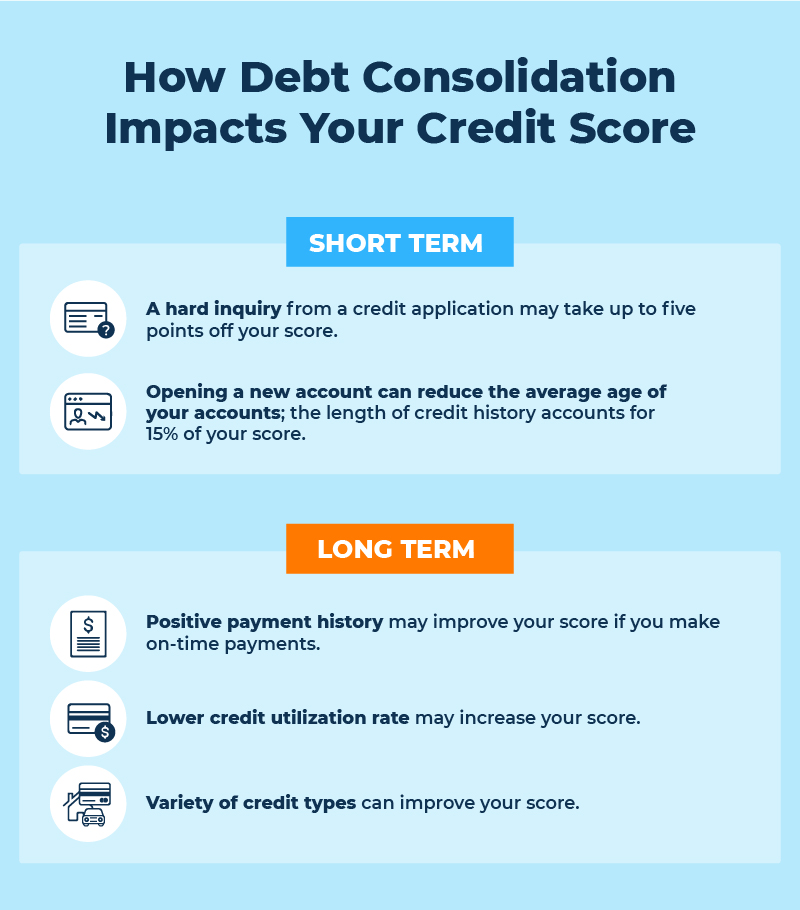

3.1 Initial impact on credit scores

Debt consolidation can have an initial impact on credit scores. When individuals apply for a new loan or debt consolidation program, it often involves a hard inquiry on their credit report. This inquiry can cause a temporary dip in credit scores, typically by a few points. However, this impact is usually minor and short-lived.

3.2 Long-term effects on credit scores

In the long term, debt consolidation can have positive effects on credit scores. By consolidating multiple debts into one and making regular payments, individuals have the opportunity to improve their creditworthiness. As they pay off their debts, reduce their credit utilization, and demonstrate responsible financial behavior, their credit scores can gradually increase over time.

4. Positive Effects of Debt Consolidation on Credit Scores

4.1 Simplified debt management

One of the key positive effects of debt consolidation on credit scores is simplified debt management. With multiple debts consolidated into a single payment, it becomes easier for individuals to keep track of their payments and avoid missed or late payments. Consistently making timely payments can have a significant positive impact on credit scores.

4.2 Decreased credit utilization ratio

Credit utilization ratio is the amount of revolving credit used compared to the total credit limit. By consolidating debts, individuals can potentially lower their credit utilization ratio, which can positively affect their credit scores. A lower credit utilization ratio signals responsible credit management and can be seen as a positive indicator by credit bureaus.

4.3 Reduced risk of late payments

Debt consolidation can also reduce the risk of late payments. When individuals have multiple debts with different due dates, it can be challenging to keep track of all payment deadlines. By consolidating debts into one monthly payment, individuals are less likely to miss payments and incur late fees. Timely payments are vital for maintaining and improving credit scores.

This image is property of goldenfs.org.

5. Negative Effects of Debt Consolidation on Credit Scores

5.1 Temporary dip in credit scores

While debt consolidation generally has positive effects on credit scores, it is important to note that there may be a temporary dip in credit scores during the initial stages. This dip is often a result of the hard inquiry made during the application process. However, this impact is minor and should not be a long-term concern for individuals.

5.2 Potential impact on credit history

Debt consolidation may have an impact on credit history. If individuals close their previous credit card accounts after consolidating their debts, it can shorten their credit history. Length of credit history is an essential factor in determining credit scores, and a shorter credit history may have a slight negative impact. It is advisable to consider the potential impact on credit history before closing any accounts.

5.3 Potential for new credit accounts

In some cases, individuals may be tempted to open new credit accounts after consolidating their debts. This can be dangerous if not done responsibly, as it can lead to increased debt and a negative impact on credit scores. It is crucial to exercise caution and avoid opening new credit accounts unless absolutely necessary.

6. Debt Consolidation Methods and Credit Scores

6.1 Credit card consolidation

Credit card consolidation involves transferring multiple credit card debts onto a single credit card or obtaining a new credit card with a balance transfer option. This method can simplify debt management and potentially reduce interest rates. However, it is important to consider the impact on credit scores and the terms of the new credit card before proceeding with credit card consolidation.

6.2 Personal loan consolidation

Personal loan consolidation involves taking out a new loan to pay off existing debts. This new loan typically has a fixed interest rate and a set repayment term. Personal loan consolidation can offer individuals lower interest rates and a predictable payment schedule. It is important to carefully compare loan terms and interest rates to ensure the best possible outcome for credit scores.

6.3 Home equity loan consolidation

For homeowners, consolidating debts through a home equity loan or a home equity line of credit (HELOC) is an option. These loans use the equity in the home as collateral. While home equity loan consolidation can provide access to lower interest rates, it is essential to consider the potential impact on credit scores and the potential risk of losing your home if loan payments are not made.

This image is property of www.nfcc.org.

7. Tips for Safeguarding Credit Scores during Debt Consolidation

7.1 Make payments on time

Making payments on time is crucial for safeguarding credit scores during debt consolidation. Late or missed payments can have a significant negative impact on credit scores. Setting up automatic payments or reminders can help ensure timely payments are made consistently.

7.2 Avoid opening new credit accounts

To maintain the positive effects of debt consolidation on credit scores, it is advisable to avoid opening new credit accounts unless absolutely necessary. Opening new accounts can increase the risk of accumulating more debt and negatively impacting credit scores.

7.3 Regularly monitor credit reports

Regularly monitoring credit reports is essential during the debt consolidation process. It allows individuals to spot potential errors or discrepancies and take appropriate action to rectify them. Additionally, monitoring credit reports helps individuals stay aware of their credit standing and track any changes to their credit scores.

8. The Role of Credit Counseling in Debt Consolidation

8.1 Benefits of credit counseling

Credit counseling can play a significant role in debt consolidation. Credit counselors provide individuals with financial advice, budgeting strategies, and debt management plans. They can help individuals navigate the debt consolidation process, negotiate with creditors, and develop a repayment plan tailored to their financial situation. Credit counseling can provide valuable support and guidance during the debt consolidation journey.

8.2 Impact on credit scores

Credit counseling itself does not directly impact credit scores. However, enrolling in a credit counseling program may have an initial impact on credit scores, similar to other debt consolidation methods. It is important to understand the potential effects on credit scores before enrolling in a credit counseling program. However, with responsible financial management and timely payments, individuals can improve their credit scores over time.

This image is property of images.ctfassets.net.

9. Potential Alternatives to Debt Consolidation

9.1 Balance transfer credit cards

Balance transfer credit cards allow individuals to transfer high-interest credit card debts to a card with a lower or 0% introductory interest rate. This can provide temporary relief from high interest payments and simplify debt management. However, it is crucial to pay off the transferred balance within the introductory period to avoid high interest charges.

9.2 Debt management programs

Debt management programs involve working with a credit counseling agency to negotiate reduced interest rates and monthly payments with creditors. These programs can be beneficial for individuals struggling with multiple debts, as they provide a structured plan for debt repayment. However, it is important to carefully research and choose a reputable credit counseling agency to ensure the best outcome for credit scores.

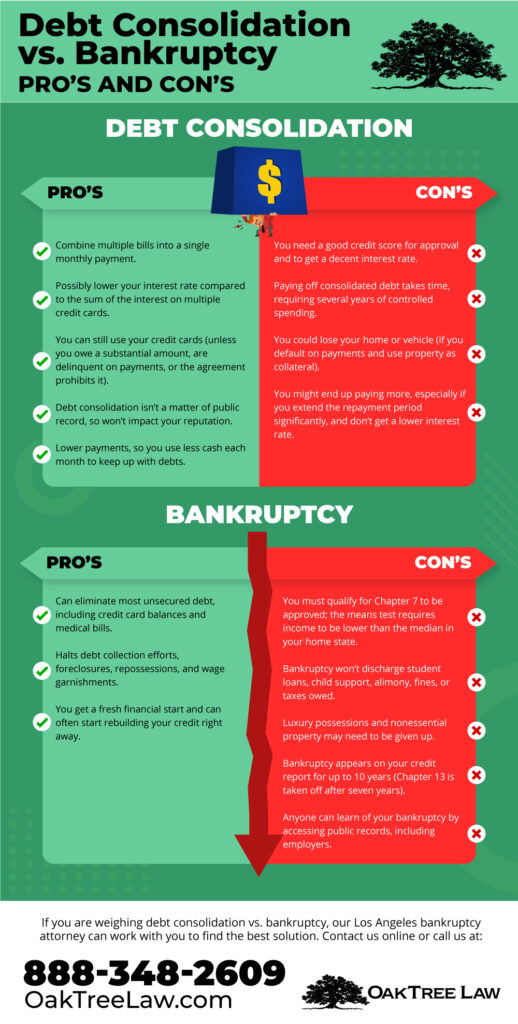

9.3 Bankruptcy

Bankruptcy should only be considered as a last resort, as it has severe and long-lasting effects on credit scores. While bankruptcy may provide relief from overwhelming debt, it can have a significant negative impact on credit scores and make it challenging to secure credit or financial opportunities in the future. It is crucial to thoroughly explore alternatives and consult with a financial professional before considering bankruptcy.

10. Conclusion

Debt consolidation can have both positive and negative effects on credit scores. While there may be an initial dip in credit scores, the long-term benefits of simplified debt management, decreased credit utilization ratio, and reduced risk of late payments can lead to improved creditworthiness. It is important to carefully consider the potential impact on credit scores when choosing a debt consolidation method and to take proactive steps to safeguard credit scores during the process. Exploring alternatives, such as balance transfer credit cards or debt management programs, can also provide viable options for individuals seeking to manage their debts. Ultimately, responsible financial management and timely payments are key to maintaining and improving credit scores throughout the debt consolidation journey.

This image is property of oaktreelaw.com.