During times of unemployment, it is crucial to stay on top of your finances, including managing your credit score. With the uncertainty that comes with being unemployed, it is important to understand the impact it can have on your credit score and take necessary steps to protect and improve it. In this article, you will discover some helpful tips and strategies to effectively manage your credit score during these challenging times.

This image is property of media.wusa9.com.

Creating a Budget

Track Your Expenses

When facing unemployment, it becomes crucial to closely monitor your expenses. Tracking your expenses allows you to gain a clear understanding of where your money is going and identify areas where you can cut back. Start by keeping a record of all your monthly expenses, including bills, groceries, transportation, and leisure activities. Use tools such as budgeting apps or spreadsheets to make this task easier and more organized. By tracking your expenses diligently, you can gain valuable insights into your spending habits and make informed decisions about managing your finances.

Identify Essential and Non-essential Spending

Once you’ve tracked your expenses, it’s essential to differentiate between essential and non-essential spending. Essential spending includes things like rent or mortgage payments, utilities, groceries, and transportation costs. Non-essential spending, on the other hand, refers to discretionary expenses such as dining out, entertainment, or luxury items. By identifying these categories, you can prioritize your essential spending and find potential areas to cut back and save money.

Cutting Back on Non-essential Spending

Cutting back on non-essential spending is vital when you’re facing unemployment. Evaluate your non-essential expenses and look for ways to minimize or eliminate them temporarily. For example, instead of eating out at restaurants, consider cooking at home and meal prepping. Look for free or low-cost alternative leisure activities, such as using the public library, hiking, or exploring local parks. By being mindful of your non-essential spending and making conscious choices, you can stretch your budget during unemployment.

Negotiating Lower Bills

Negotiating lower bills can be incredibly helpful when you’re facing financial difficulties. Contact your service providers, such as internet, cable, and phone companies, and explain your situation. Many companies offer temporary hardship programs or may be willing to negotiate a lower monthly payment. Additionally, consider exploring options to reduce your utility bills by making your home more energy-efficient or adjusting your usage habits. Taking the time to negotiate lower bills can significantly alleviate the financial burden during unemployment.

Monitoring Your Credit Report

Importance of Monitoring

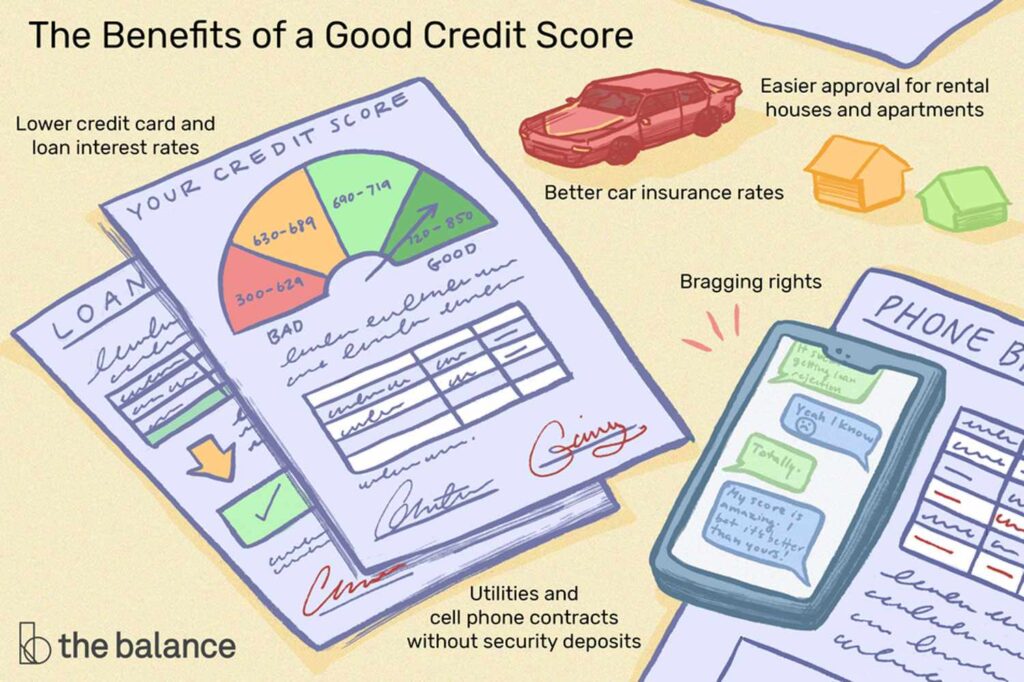

Monitoring your credit report is crucial, especially during unemployment. Your credit report provides a comprehensive overview of your credit history, including payment history, outstanding debts, and credit utilization. By regularly monitoring your credit report, you can ensure its accuracy, detect any errors or fraudulent activities, and maintain a healthy credit score. Your credit score plays a significant role in various aspects of your financial life, such as securing loans, renting an apartment, or even getting a job. Therefore, it’s essential to stay vigilant and monitor your credit report regularly.

Reviewing Your Credit Report

Reviewing your credit report allows you to assess your financial standing and identify any discrepancies or inaccuracies. Obtain a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) and carefully review the information provided. Check for any inconsistencies, such as incorrect personal information, unauthorized accounts, or late payments that you believe are inaccurate. If you notice any errors, be sure to take immediate action to rectify them, as they can have a negative impact on your credit score.

Disputing Errors or Inaccurate Information

If you discover any errors or inaccurate information on your credit report, it’s essential to take steps to dispute them promptly. Contact the credit bureau reporting the error and provide them with all relevant documentation supporting your claim. The credit bureau is legally obliged to investigate the matter within 30 days and correct any inaccuracies. Additionally, reach out to the entity that provided the incorrect information and inform them of the dispute. Disputing errors or inaccurate information on your credit report helps maintain the integrity of your credit history and ensures your credit score is a true reflection of your financial behavior.

Regularly Checking for Updates

Credit reports are constantly changing as new information is reported. It’s crucial to make it a habit to regularly check for updates on your credit report. Set a reminder to review your credit report at least once a year or before any significant financial decision. By regularly monitoring your credit report, you can catch any potential issues early on and take appropriate action to rectify them. This proactive approach will help you maintain a healthy credit score and financial stability.

Communicating with Creditors

Contacting Your Creditors

When facing unemployment, it’s important to establish open lines of communication with your creditors. Contact each of your creditors and inform them about your current situation. By reaching out to them proactively, you demonstrate your willingness to address your financial obligations responsibly. Be prepared to provide them with relevant information, such as your estimated timeline of unemployment and your plans for managing your debts. Clear and effective communication lays the foundation for finding mutually beneficial solutions.

Explaining Your Situation

When speaking with your creditors, it’s crucial to explain your situation honestly and transparently. Share the details of your job loss, including any severance pay or unemployment benefits you may be receiving. Provide them with a realistic assessment of your financial capabilities during your unemployment period. By being open about your situation, you increase the likelihood of them being understanding and willing to work with you towards a solution.

Negotiating Temporary Reduced Payments or Payment Plans

When facing financial hardships, negotiating temporary reduced payments or payment plans can make a significant difference. Speak with your creditors about the possibility of reducing your monthly payments temporarily, based on your current income. Many creditors are willing to offer assistance programs or work out a modified payment plan that aligns with your financial situation. By negotiating reduced payments or payment plans, you can create a more manageable payment structure during your unemployment.

Requesting Payment Deferrals

Another option to consider when communicating with your creditors is the possibility of payment deferrals. Requesting a payment deferral allows you to temporarily postpone making payments on certain debts. This can provide essential breathing room during your period of unemployment. Discuss the option of payment deferrals with your creditors and inquire about any additional fees or interest that may be incurred. Carefully evaluate the terms and impact on your overall financial situation before committing to a payment deferral.

Utilizing Available Assistance Programs

Researching Government Assistance Programs

During unemployment, it’s essential to research government assistance programs that may be available to help you during this challenging time. Look into unemployment benefits provided by your local government and understand the eligibility criteria and application process. Additionally, explore other support programs such as food assistance, healthcare subsidies, or rental assistance. Taking advantage of these programs can provide temporary relief and help you cover essential expenses while you search for new employment.

Applying for Unemployment Benefits

One of the most immediate forms of assistance available to individuals facing unemployment is applying for unemployment benefits. Unemployment benefits are designed to provide financial support to individuals who have lost their jobs involuntarily. Contact your local unemployment office or visit their website to understand the application process and required documentation. Be prompt in submitting all necessary paperwork to expedite the approval process and start receiving your benefits as soon as possible.

Exploring Local Non-profit Organizations and Charities

Local non-profit organizations and charities often offer various forms of assistance to individuals facing financial hardships. Research organizations in your area that provide support for basic necessities, such as food banks, clothing drives, or utility bill assistance. These organizations can offer temporary relief and help you cover essential expenses. Reach out to these organizations for guidance and inquire about any specific programs or assistance they may have available to individuals in your situation.

Seeking Mortgage and Rent Relief Programs

Housing expenses, such as mortgage or rent payments, can be overwhelming during unemployment. However, there may be relief programs available to help alleviate this financial burden. Research local and federal programs that offer mortgage or rent relief, such as loan modification programs or eviction moratoriums. Contact your mortgage lender or landlord to discuss the potential for temporary relief or payment arrangements. Being proactive and seeking out these programs can provide you with much-needed support and help you maintain stability in your living situation during unemployment.

This image is property of www.thebalancemoney.com.

Maintaining a Healthy Debt-to-Income Ratio

Understanding Debt-to-Income Ratio

Your debt-to-income ratio (DTI) is a crucial financial metric that lenders use to evaluate your ability to manage debt. Understanding your DTI is important, as it reflects your overall financial health and your capacity to take on additional debt. To calculate your DTI, divide your total monthly debt payments by your gross monthly income and multiply by 100. A lower DTI percentage indicates a healthier financial position. During unemployment, it’s vital to maintain a low DTI ratio to minimize financial strain and increase your chances of obtaining credit when needed.

Paying Off High-Interest Debt

Paying off high-interest debt should be a priority when managing your finances during unemployment. High-interest debts, such as credit cards or personal loans, can accumulate significant interest charges over time and increase your financial burden. Focus on paying off these debts with the highest interest rates first, utilizing any available funds or savings. Consider implementing a debt repayment strategy, such as the snowball or avalanche method, to systematically eliminate your high-interest debts. By prioritizing debt repayment, you can free up more funds for essential expenses and improve your financial outlook.

Avoiding Taking on New Debt

When facing unemployment, it’s crucial to avoid taking on any new debt whenever possible. Adding to your debt load during this period can further strain your finances and increase your financial vulnerability. Be mindful of your spending habits and resist the temptation to rely on credit cards or loans for non-essential expenses. Instead, focus on conserving your financial resources and minimizing unnecessary expenditures. By avoiding new debt, you can better navigate the challenges of unemployment and maintain financial stability.

Considering Debt Consolidation

If you have multiple debts with varying interest rates, consider exploring debt consolidation as an option. Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This can simplify your repayment process and potentially reduce your monthly payments, making it more manageable during unemployment. However, it’s important to carefully assess the terms and fees associated with debt consolidation before proceeding. Consult with a financial advisor or credit counseling agency to determine if debt consolidation is a suitable option for your specific situation.

Using Credit Wisely

Limiting Credit Card Usage

During unemployment, it’s important to limit your credit card usage to essential expenses only. Relying heavily on credit cards can quickly accumulate debt and lead to financial stress. Create a realistic monthly budget and stick to it, ensuring that your credit card expenses align with your financial resources. Only use your credit cards when necessary and avoid falling into the trap of using them for non-essential purchases. By limiting your credit card usage, you can prevent unnecessary debt and maintain better control over your financial situation.

Avoiding Opening New Credit Accounts

Opening new credit accounts during unemployment can be tempting, especially if you’re facing financial challenges. However, it’s crucial to resist the urge to seek new credit. Opening new credit accounts can potentially harm your credit score and increase your debt load, making it even more challenging to manage your finances. Focus on navigating your existing financial responsibilities and strengthening your financial stability before considering new credit options. By avoiding new credit accounts, you can better protect your credit score and maintain a healthier financial outlook.

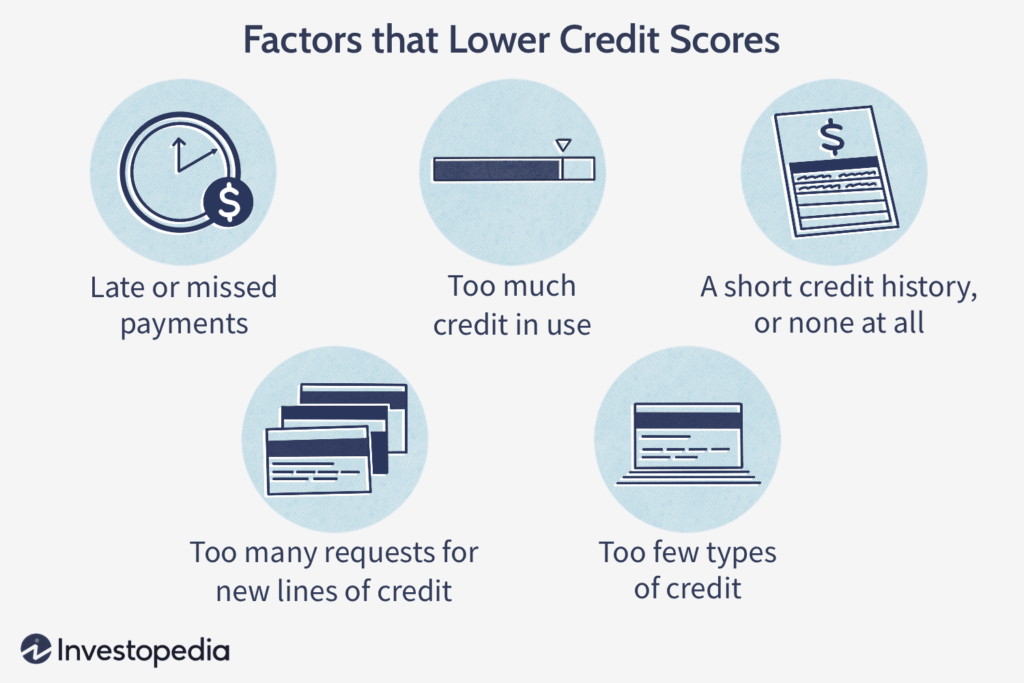

Making Timely Payments

Making timely payments on your credit obligations is imperative, regardless of your employment situation. Late or missed payments can negatively impact your credit score and make it more difficult to secure credit in the future. Even if you’re facing financial hardships, make it a priority to pay at least the minimum amount due on your credit accounts to avoid any negative consequences. Utilize reminders or automatic bill payments to ensure you never miss a payment deadline. By consistently making timely payments, you demonstrate responsibility and safeguard your credit score.

Keeping Credit Utilization Low

Credit utilization refers to the amount of available credit you’re currently using. Keeping your credit utilization low is vital for maintaining a healthy credit score and financial stability. During unemployment, focus on minimizing your credit card balances and lowering your overall credit utilization ratio. Aim to keep your credit card balances below 30% of your available credit limit. If possible, consider paying off your credit card balances in full each month to prevent unnecessary interest charges. By keeping your credit utilization low, you present yourself as a responsible borrower and improve your chances of accessing credit when needed.

This image is property of www.investopedia.com.

Protecting Your Credit Score

Avoiding Credit Repair Companies

When facing financial challenges, it’s important to be wary of credit repair companies that claim to be able to improve your credit score quickly or remove negative information from your credit report. Many of these companies engage in fraudulent practices and exploit individuals who are already in vulnerable situations. Instead of relying on these services, focus on establishing healthy credit habits and working diligently to improve your credit score over time. Avoiding credit repair companies helps protect your financial well-being and ensures that you follow legitimate strategies to manage your credit.

Monitoring for Identity Theft

During unemployment, it’s crucial to remain vigilant and monitor for any signs of identity theft. Unemployment and financial instability can make individuals more vulnerable to identity theft, as criminals may attempt to exploit the situation for personal gain. Regularly review your financial statements, credit reports, and bank accounts for any suspicious activity. Report any unauthorized accounts or transactions immediately to your financial institution and the credit bureaus. By actively monitoring for identity theft, you can minimize potential damage and protect your credit score.

Freezing Your Credit

Freezing your credit is an effective way to prevent identity thieves from opening new accounts in your name. By placing a freeze on your credit, you restrict access to your credit file, making it difficult for unauthorized individuals to apply for credit using your personal information. Contact each of the three major credit bureaus to initiate a credit freeze. Once frozen, you’ll need to lift the freeze temporarily when applying for credit or loans. Freezing your credit offers an additional layer of protection during unemployment and ensures that your credit remains secure.

Limiting Credit Inquiries

Excessive credit inquiries can raise red flags to lenders and potentially have a negative impact on your credit score. During unemployment, avoid unnecessary credit inquiries unless absolutely necessary. This includes applying for new credit cards, loans, or financing options. Limiting credit inquiries sends a signal to lenders that you’re actively managing your credit and not seeking excessive amounts of credit. Be strategic about when and why you apply for new credit, ensuring that it aligns with your financial goals and needs.

Exploring Alternate Sources of Income

Freelancing or Gig Work

Exploring freelance or gig work can provide an additional source of income during unemployment. Consider leveraging your skills or expertise in areas such as writing, graphic design, web development, or online tutoring. Numerous online platforms connect freelancers with clients seeking their services. Sign up on these platforms and create a compelling profile highlighting your skills and experience. Freelancing or gig work offers flexibility and the opportunity to earn money on your terms, helping to mitigate the financial strain of unemployment.

Translating Skills to Remote Work

In today’s digital age, remote work has become increasingly prevalent. Take stock of your skills and consider how they can be translated to remote work opportunities. Research companies or industries that offer remote job opportunities aligned with your expertise. Update your resume to highlight your remote work capabilities or consider obtaining relevant certifications to enhance your marketability. By exploring remote work options, you can expand your employment prospects and potentially secure a stable source of income during unemployment.

Part-time or Temporary Jobs

When facing unemployment, acquiring part-time or temporary employment can be an effective way to generate income while you search for a more permanent job. Look for part-time or temporary job opportunities in your area or consider taking on short-term gigs. These jobs may provide financial stability and bridge the gap until you secure a long-term employment opportunity. Be open-minded and willing to explore different industries or roles that may not align with your previous experience. Taking on part-time or temporary work demonstrates your determination and resilience during this challenging period.

Starting a Side Business

If you possess an entrepreneurial mindset, starting a side business can be a viable option during unemployment. Consider your skills and interests and explore possible business ideas that could generate income. Develop a business plan and research the market to identify any gaps or opportunities. Starting a side business may require a financial investment, so carefully assess your available resources and create a budget. While starting a business can be challenging, it offers the potential for long-term financial independence and can serve as a valuable asset in your career journey.

This image is property of images.ctfassets.net.

Seeking Financial Advice

Contacting Credit Counseling Agencies

When navigating financial challenges during unemployment, seeking assistance from credit counseling agencies can be beneficial. Credit counseling agencies provide guidance and support in managing debt, developing budgets, and improving overall financial literacy. Contact reputable credit counseling agencies in your area and inquire about their services. They can provide personalized advice tailored to your specific financial situation and help you create a roadmap towards financial stability. By seeking professional guidance, you gain valuable insights and resources to effectively manage your finances.

Consulting with Financial Advisors

Consulting with a financial advisor can also be a wise decision during unemployment. Financial advisors are trained professionals who can help you evaluate your financial goals, assess your current situation, and create a comprehensive financial plan. They can provide expertise on investment strategies, retirement planning, and overall wealth management. Look for certified financial planners (CFPs) or accredited financial counselors (AFCs) who have a proven track record and are committed to acting in your best interest. Consulting with a financial advisor can provide you with the confidence and guidance needed to make informed financial decisions during unemployment.

Attending Financial Literacy Workshops

Financial literacy workshops offer valuable educational resources and insights into managing personal finances. Look for workshops focused on topics such as budgeting, debt management, investment strategies, or retirement planning. Many community organizations, libraries, or non-profit agencies offer free or low-cost financial literacy workshops. Attending these workshops can expand your knowledge and equip you with the tools necessary to make informed financial decisions. By actively seeking knowledge and skills, you can enhance your financial capabilities and increase your chances of long-term financial success.

Joining Support Groups

Joining support groups dedicated to financial well-being can provide a valuable network of individuals facing similar challenges. These support groups offer a safe environment to share experiences, learn from others, and receive emotional support during times of financial uncertainty. Look for local or online groups that focus on topics such as unemployment, debt management, or personal finance. By joining these groups, you gain access to resources, tips, and encouragement from individuals who understand the unique struggles associated with managing finances during unemployment.

Preparing for Future Employment

Enhancing Your Skillset

During unemployment, investing in enhancing your skillset can significantly improve your chances of securing future employment. Identify areas where you can acquire new skills or enhance existing ones. Consider online courses, workshops, or certifications that align with the industries or roles you wish to pursue. Upskilling or gaining additional qualifications demonstrates your commitment to personal and professional development. Continuously expanding your skillset makes you a more competitive candidate in the job market and increases your long-term employability.

Obtaining Certifications or Degrees

In some industries, obtaining certifications or degrees is essential to secure employment or advance your career. Use your unemployment period as an opportunity to pursue any necessary certifications or degrees that can enhance your qualifications. Research accredited institutions or online learning platforms that offer relevant programs aligned with your career goals. Assess the financial feasibility of obtaining these certifications or degrees and explore scholarship or financial aid options. By investing in your education, you’re investing in your future employment prospects.

Updating Your Resume and LinkedIn Profile

Your resume and LinkedIn profile are essential tools in your job search. During unemployment, take the time to update your resume and LinkedIn profile to reflect your most recent experiences, skills, and accomplishments. Tailor your resume to align with the specific job opportunities you’re pursuing and ensure that it accurately represents your qualifications. Likewise, optimize your LinkedIn profile to showcase your professional brand and make it easy for potential employers to find and connect with you. Updating your resume and LinkedIn profile demonstrates your proactive approach and professionalism in seeking new employment.

Networking and Attending Job Fairs

Networking plays a crucial role in accessing new employment opportunities. During unemployment, make it a priority to network and connect with professionals in your desired industry or field. Attend virtual or in-person job fairs, industry events, or professional networking gatherings. Engage in conversations, ask questions, and actively seek out opportunities to exchange contact information. Leverage your existing network and inform friends, family, and former colleagues about your job search. Often, job opportunities arise through referrals and personal connections. By actively networking, you can increase your visibility and uncover hidden employment prospects.

In conclusion, managing your credit score during unemployment requires proactive planning and strategic decision-making. By creating a budget, monitoring your credit report, communicating with creditors, utilizing available assistance programs, maintaining a healthy debt-to-income ratio, using credit wisely, protecting your credit score, exploring alternate sources of income, seeking financial advice, and preparing for future employment, you can navigate unemployment more effectively and safeguard your financial well-being. Remember that this period is temporary and with diligence and perseverance, you can overcome the challenges and come out stronger on the other side.

This image is property of loanscanada.ca.