Are you overwhelmed by mounting credit card debt and struggling to make ends meet? Look no further! In this article, we will provide a comprehensive review of non-profit credit counseling services. Whether you’re looking for practical tips on managing your debt or seeking assistance in negotiating with creditors, we’ve got you covered. Discover how these services can help you regain control of your finances and pave the way towards a debt-free future.

What are non-profit credit counseling services?

Non-profit credit counseling services are organizations that offer assistance and guidance to individuals who are struggling with debt and financial management. These services are typically provided by non-profit organizations that aim to help individuals regain control of their finances and improve their financial well-being.

Definition

Non-profit credit counseling services are agencies that offer a range of services to individuals facing financial difficulties. These services can include debt management plans, budgeting assistance, credit report review and counseling, education and financial literacy programs, and even bankruptcy counseling. The goal of these organizations is to provide individuals with the tools and resources they need to make informed financial decisions and effectively manage their debt.

How do they work

When you reach out to a non-profit credit counseling service, you will typically undergo a thorough financial assessment. This assessment will help the counselor understand your financial situation, including your income, expenses, and debt obligations. Based on this assessment, the counselor will work with you to develop a personalized plan to address your financial challenges.

Non-profit credit counseling services often work with your creditors to negotiate more favorable terms on your behalf. This can include reducing interest rates, waiving late fees, and creating a more manageable repayment plan. Once the plan is in place, you will make monthly payments to the credit counseling agency, which will then distribute the funds to your creditors according to the agreed-upon terms.

Benefits of non-profit credit counseling services

Non-profit credit counseling services offer several benefits to individuals struggling with debt. These benefits include:

-

Expert advice: Credit counselors are trained professionals who have extensive knowledge and experience in dealing with debt and financial management. They can provide you with personalized advice and guidance based on your specific financial situation.

-

Debt relief: Non-profit credit counseling services can help you create a feasible repayment plan that fits within your budget. They may also negotiate with your creditors to reduce interest rates and fees, making it easier for you to repay your debt.

-

Financial education: These services often provide educational resources and workshops to help improve your financial literacy. You can learn valuable skills such as budgeting, saving, and managing credit effectively.

-

Emotional support: Dealing with debt and financial difficulties can be stressful and overwhelming. Non-profit credit counseling services offer emotional support and a judgment-free environment where you can discuss your concerns and receive guidance.

By utilizing the services of a non-profit credit counseling agency, you can take the first step towards financial freedom and regain control of your financial situation.

How to choose a non-profit credit counseling service

Choosing the right non-profit credit counseling service is crucial for achieving your financial goals. Consider the following factors when selecting a service:

Accreditation

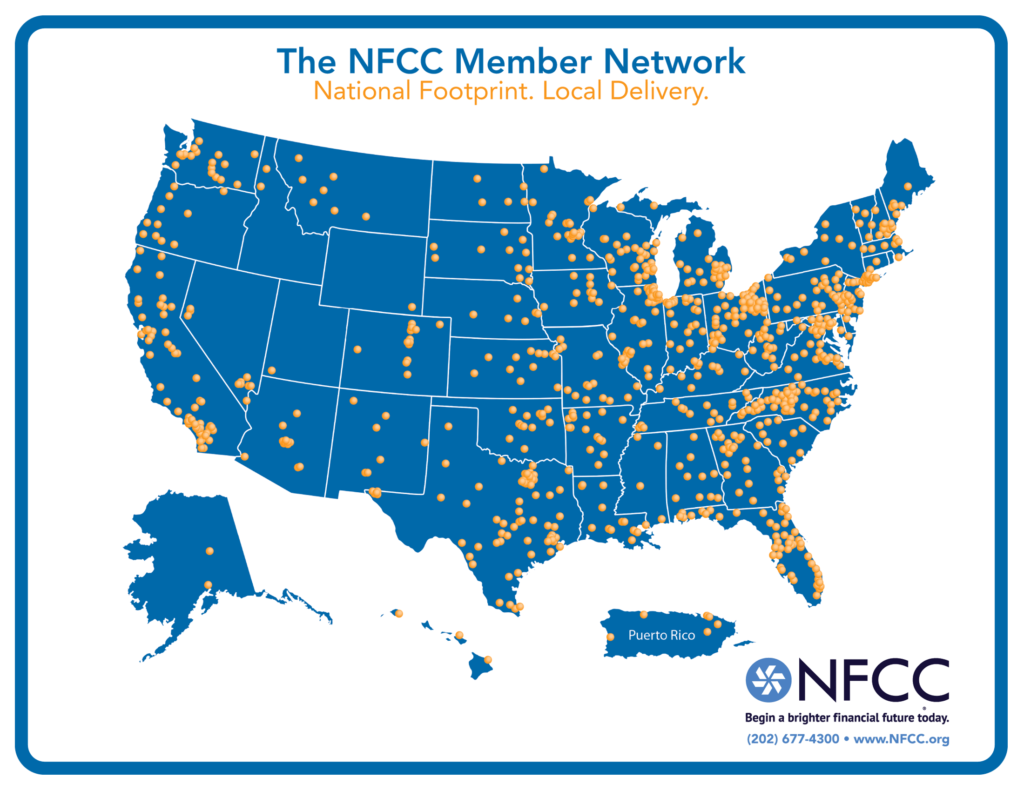

Look for a credit counseling agency that is accredited by a reputable organization such as the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA). Accreditation ensures that the agency adheres to high standards and follows best practices in the credit counseling industry.

Experience and qualifications

Consider the experience and qualifications of the counselors working for the agency. Look for professionals who have certifications such as Certified Financial Counselor (CFC) or Certified Credit Counselor (CCC). Experience in dealing with similar financial situations can also be beneficial in determining the agency’s expertise.

Services offered

Evaluate the range of services offered by the credit counseling agency. Ensure that they provide the specific assistance you require, such as debt management plans, credit report review, or bankruptcy counseling. It is also beneficial to choose an agency that offers comprehensive financial education programs to help you develop essential money management skills.

Fees

Inquire about the fees associated with the credit counseling services. Non-profit agencies typically charge a nominal fee for their services, but it is important to understand the costs upfront. Be cautious of agencies that require large upfront fees or make unrealistic promises regarding debt reduction.

Online resources and tools

Consider whether the credit counseling agency provides online resources and tools to assist you in managing your finances. These can include budgeting calculators, debt repayment calculators, and educational materials. Online resources can be valuable in maintaining your financial progress and staying on track with your goals.

By carefully considering these factors, you can select a non-profit credit counseling service that aligns with your needs and goals.

This image is property of thumbor.forbes.com.

Top non-profit credit counseling agencies

When choosing a non-profit credit counseling agency, it can be helpful to consider the top agencies in the industry. Here are five reputable organizations that provide excellent credit counseling services:

Agency 1

Agency 1 is a well-established non-profit credit counseling agency with over 20 years of experience in the industry. They offer a wide range of services, including debt management plans, credit report review, and educational resources. They have a team of highly qualified credit counselors who can provide personalized advice tailored to your financial situation.

Agency 2

Agency 2 is another trusted non-profit credit counseling agency that has been assisting individuals with their financial challenges for over 15 years. They have a strong track record of success and offer comprehensive debt management plans and financial education programs. Their counselors are known for their expertise and compassionate approach.

Agency 3

Agency 3 has built a solid reputation for providing quality non-profit credit counseling services. They have a team of experienced counselors who can guide you through the process of debt management and help you develop effective strategies to improve your financial health. Their online resources and tools are user-friendly and can assist you in managing your finances effectively.

Agency 4

Agency 4 is a non-profit credit counseling agency known for its personalized approach and attention to detail. Their counselors take the time to understand your unique financial situation and create customized plans tailored to your needs. They offer practical solutions such as debt management plans and budgeting assistance, along with educational resources to enhance your financial literacy.

Agency 5

Agency 5 has established itself as a leading non-profit credit counseling agency, focusing on providing holistic financial solutions to individuals in need. They offer a comprehensive range of services, including debt management plans, credit report review, and educational workshops. Their counselors are committed to helping you achieve long-term financial stability.

Consider researching these top non-profit credit counseling agencies and evaluating their services to determine which one best aligns with your financial needs and goals.

Pros and cons of non-profit credit counseling services

Non-profit credit counseling services offer several advantages for individuals facing financial challenges. However, it is important to weigh these benefits against any potential disadvantages. Here are some pros and cons to consider:

Advantages

-

Expert guidance: Non-profit credit counseling agencies have trained professionals who can provide you with expert guidance and advice to help you navigate your financial difficulties.

-

Debt management plans: These agencies can assist you in developing a debt management plan that consolidates your debts and provides a structured repayment schedule.

-

Creditors negotiation: Non-profit credit counseling services often have established relationships with creditors, allowing them to negotiate more favorable terms on your behalf.

-

Financial education: These services offer educational resources and workshops to help improve your financial literacy and develop essential money management skills.

Disadvantages

-

Impact on credit score: Enrolling in a debt management plan provided by a non-profit credit counseling agency may initially have a negative impact on your credit score. However, with consistent payments and improved financial management, your credit score can recover over time.

-

Limited options for complex situations: Non-profit credit counseling services may not be suitable for individuals facing more complex financial situations, such as those involving significant assets or business debts. In such cases, consulting with a financial advisor or attorney may be necessary.

-

Monthly fees: While non-profit agencies typically charge reasonable fees, it is important to consider the monthly payments associated with debt management plans. Be sure to factor in these costs when evaluating the affordability of the service.

By considering these pros and cons, you can make an informed decision about whether non-profit credit counseling services are the right choice for you.

This image is property of clark.com.

How non-profit credit counseling services can help improve your financial situation

Non-profit credit counseling services offer various tools and resources to help individuals improve their financial situation. Here are some ways these services can assist you:

Debt management plans

One of the primary services offered by non-profit credit counseling agencies is a debt management plan (DMP). Under a DMP, the agency works with your creditors to negotiate lower interest rates, reduced monthly payments, and the elimination of late fees. This makes it easier for you to repay your debts within a set timeframe.

A DMP consolidates all your eligible debts into one monthly payment, which is then distributed to your creditors by the credit counseling agency. This simplifies the repayment process and helps you stay on track with your payments.

Budgeting assistance

Non-profit credit counseling services can provide valuable guidance and support in creating a realistic budget. A budget helps you track your income and expenses, allowing you to prioritize debt repayment and manage your finances effectively. Credit counselors can work with you to identify areas where you can reduce spending, increase savings, and allocate funds towards debt repayment.

Credit report review and counseling

Credit counselors can review your credit report and provide insights into improving your credit score. They can help you identify any errors or discrepancies on your report and guide you through the process of disputing inaccuracies. Additionally, they can offer advice on strategies to rebuild your credit and establish healthy credit habits.

Education and financial literacy

Non-profit credit counseling agencies often offer educational programs and resources to improve financial literacy. These programs can cover a wide range of topics, such as budgeting, saving, understanding credit, and avoiding debt. By participating in these programs, you can develop the necessary skills and knowledge to make informed financial decisions.

Bankruptcy counseling

If you are facing significant financial hardship and considering bankruptcy as an option, non-profit credit counseling services can provide bankruptcy counseling. They can help you understand the implications of filing for bankruptcy, explore alternative solutions, and guide you through the necessary steps.

By utilizing the services provided by non-profit credit counseling agencies, you can take advantage of their expertise and resources to improve your financial situation and work towards a secure financial future.

Alternatives to non-profit credit counseling services

While non-profit credit counseling services can be beneficial for many individuals, there are alternative options to consider depending on your specific circumstances. Here are two alternatives worth exploring:

Self-help tools and resources

For individuals who prefer a more independent approach, self-help tools and resources can be a viable alternative. Many reputable financial websites and apps offer budgeting tools, debt calculators, and educational resources. These resources allow you to develop and implement your own financial management strategies. However, it is crucial to ensure that the information and resources you utilize are from reliable sources.

For-profit credit counseling services

For-profit credit counseling services are another alternative. These agencies operate with a fee-based model, charging for their services. While they may offer similar services to non-profit agencies, it is important to thoroughly research and compare the fees and reputation of the for-profit agencies. Ensure that they are transparent about their fees and have a proven track record of helping individuals successfully manage their debt.

By considering these alternatives, you can choose the approach that suits your preferences and specific financial situation.

This image is property of thumbor.forbes.com.

Frequently asked questions about non-profit credit counseling services

What is the difference between non-profit and for-profit credit counseling services?

The primary difference between non-profit and for-profit credit counseling services lies in their organizational structure and funding. Non-profit agencies are typically funded by grants and donations and are committed to helping individuals achieve financial stability. For-profit agencies, on the other hand, operate on a fee-based model and aim to generate profits for their shareholders. While both types of agencies may provide similar services, non-profit agencies are generally seen as more trustworthy and focused on the best interests of their clients.

How long does credit counseling take?

The length of credit counseling varies depending on your unique financial situation. The initial assessment and development of a debt management plan may take a few weeks. Subsequent counseling sessions and progress monitoring can extend the duration of credit counseling. However, credit counseling is not a one-time event; it typically involves ongoing support and guidance until you have successfully achieved your financial goals.

Is credit counseling a good option for everyone?

Credit counseling can be beneficial for individuals facing financial difficulties, struggling with debt, or seeking to improve their financial management skills. It provides expert guidance, debt management plans, and educational resources that can help individuals regain control of their finances. However, credit counseling may not be suitable for everyone. Individuals facing more complex financial situations or those with significant business debts may need to consult with a financial advisor or attorney for specialized assistance.

Can credit counseling services negotiate with creditors?

Yes, non-profit credit counseling services can negotiate with your creditors to help you obtain more favorable terms. Through their established relationships with creditors, they may be able to reduce interest rates, waive late fees, or create a more manageable repayment plan. This can make it easier for you to repay your debts and regain control of your financial situation.

Will credit counseling services hurt my credit score?

Enrolling in a debt management plan through a non-profit credit counseling service may initially have a negative impact on your credit score. This is because creditors may report your participation in the plan to the credit bureaus, which could be seen as a flag indicating difficulty managing your debts. However, with consistent payments and improved financial management, your credit score can recover over time.

Can I still use credit while on a debt management plan?

While on a debt management plan, it is generally advisable to limit your use of credit. The purpose of a debt management plan is to help you reduce your debt and improve your financial situation. Taking on new debt during this time can hinder your progress and make it more challenging to achieve your goals. It is important to make responsible financial decisions and focus on repaying your existing debt rather than taking on new credit obligations.

Conclusion

Non-profit credit counseling services offer valuable assistance and guidance to individuals struggling with debt and financial management. These organizations provide expert advice, debt management plans, budgeting assistance, credit report review and counseling, and educational resources to help individuals regain control of their finances. By carefully selecting a reputable agency, individuals can access the tools and support necessary to improve their financial situation and work towards long-term financial stability.

It is important to consider the benefits and disadvantages of non-profit credit counseling services, as well as alternative options such as self-help tools and for-profit credit counseling services. Each individual’s financial situation is unique, and it is essential to choose the approach that aligns with their goals and needs.

With the right support and resources, individuals can navigate their financial challenges, develop healthy financial habits, and build a brighter financial future.

This image is property of thumbor.forbes.com.